₱ 30,990

PHILIPPPINE PEACHTREE TO HELP YOU WITH YOUR REGULAR TAX COMPLIANCE

The Philippines’ Bureau of Internal Revenue through Revenue Regulation No. 09-2009 defines the requirements, obligations and responsibilities of Philippine taxpayers. Compliance with the reporting requirements of the revenue body, in this case the BIR, is supposed to be built into the accounting system that a company considers putting in place.

What matters of utmost importance in business, is paying taxes and recording its financial accounts in a manner prescribed by tax authorities and regulators. No organization exists in a vacuum and for a company to gain legitimacy in the eyes of its existing and potential customers, it must be compliant to tax policies of the internal revenue body. In the case of the Philippines, this is the Bureau of Internal Revenue.

The BIR, through its Revenue Regulation No. 09-2009, has defined the requirements, obligations and responsibilities of Philippine taxpayers. This pertains to the use of electronic systems or the Computerized Accounting System (CAS) for record-keeping, maintenance of records and books of accounts.

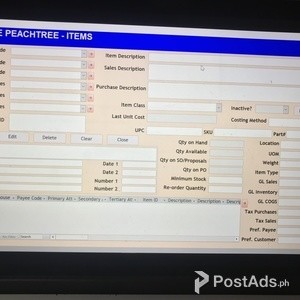

All of these standard forms and reports are provided by the Philippine Peachtree. Among the standard forms offered by this, such as the purchase order, goods receipt PO, goods returns, A/P debit memo, A/P voucher, sales quotation, sales order, delivery, returns, A/R credit memo, AR invoice, incoming payment, goods issued and inventory transfer we also offer:

Standard reports provided in the software are the balance sheet, trial balance, profit and loss statement, cash flow, general ledger report, aging report, transaction journal report, document journal, cash flow reference, withholding tax report, VAT reconciliation report, check register report, item list, last prices report, inventory posting list, inventory status report, inventory valuation simulation report, serial numbers report, batch numbers report, open items list, and order recommendat

- Never pay in advance to a seller that you do not know.

- Even if the seller discloses his/her personal information or bank account number, this does not protect you from being cheated.

- Always request for the original receipt of purchase from the seller, to verify that he/her is the rightful owner of the item; and to verify that the item is authentic.

- Avoid sending goods or payment; instead, meet in person and do COD (Cash on Delivery).

- Meet at a public place to deal.

Make Everything Automated - Switch to Philippine ERP

Philippine ERP for your Automated Data Management

Philippine ERP now AVAILABLE for your Automated Data Management Needs

Best Accounting and Payroll System SAGE 50 Peachtree

HOUSE AND LOT SALE (Installment)

Programmed Assessment of Data and Account for your Business

SAGE 50 Local Version - Philippine Peachtree

Your Business Booster - Automated Processes

Rent to own near Metro Manila – Imus

Peachtree Reincarnated thru Philippine Peachtree

BC game

Stake Clone Script – Profitable Solution for Crypto Casino Entrepreneur

SpotnRides

Speak. Ride. Repeat. – Voice-Controlled Taxi Booking App Development!

Touch Typist

Be a Touch Typist

Plurance classifieds

Kickstart Your All-in-One Super Crypto App with Top-Features

Plurance classifieds

Start Your High-Revenue Payment Gateway Venture with Phonepe Clone

Plurance

Launch a next gen exchange with our custom whitelabel crypto exchange s

Virtual Mall

Thesis, Capstone, Game Developer, Mobile App, Website, Software Develop

Virtual Assistance Philippines

Virtual Assistance Philippines

Create Your Own Token with Hivelance The Expert Cryptocurrency Developm

Mobile App Development Company